Having affordable car insurance is crucial for Americans. It not only provides financial protection in case of accidents but also ensures compliance with state laws requiring vehicle insurance.

In the United States, having reliable car insurance coverage can be a significant financial safeguard. With the rising costs of vehicle repairs and medical bills, a good car insurance policy can be a lifesaver.

Key Takeaways

- Affordable car insurance is essential for financial protection.

- Reliable car insurance coverage ensures compliance with state laws.

- Having the right car insurance policy can safeguard against financial loss.

- It’s crucial to compare different insurance policies to find the most affordable one.

- Understanding the terms of your car insurance coverage is vital.

Understanding the Basics of Car Insurance in America

Navigating the world of car insurance can be daunting, but understanding its basics is crucial for every American driver. Car insurance is not just a legal necessity in most states; it’s a financial safety net that protects drivers from the potentially high costs associated with vehicle accidents or damage.

What Car Insurance Actually Covers

Car insurance policies are designed to cover a variety of risks, including damage to or loss of the insured vehicle, liability for injuries or damages to others, and medical expenses for the driver and passengers. Liability coverage is a critical component, as it pays for damages to others if the insured driver is at fault in an accident. Comprehensive and collision coverage, on the other hand, protect the insured vehicle against damage or loss, regardless of fault.

As Consumer Reports notes, “The right coverage can help you avoid financial ruin if you’re involved in an accident.” Understanding what your car insurance covers is essential to making informed decisions about your policy.

Why Car Insurance is Mandatory in Most States

Car insurance is mandatory in most states because it ensures that drivers can cover the costs of damages or injuries they may cause to others. By having insurance, drivers are more likely to be able to pay for the consequences of their actions on the road, thereby protecting other drivers, pedestrians, and passengers. As

“The primary purpose of car insurance is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise therefrom.”

This requirement is in place to maintain public safety and financial responsibility on the roads.

In conclusion, understanding the basics of car insurance is vital for all drivers. It not only helps in complying with state laws but also provides financial security in the event of unforeseen circumstances.

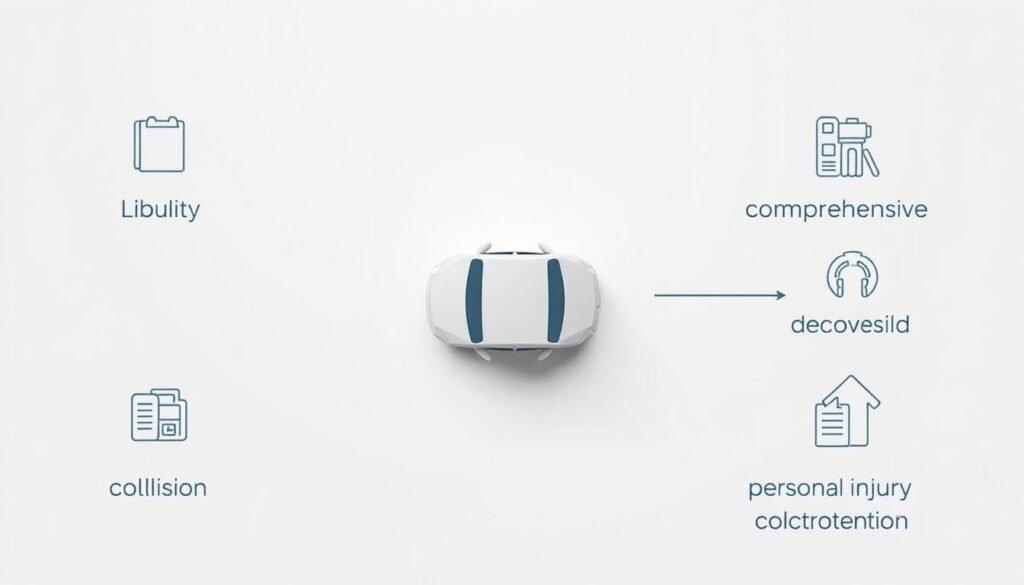

Types of Car Insurance Coverage Available

When it comes to car insurance, understanding the different types of coverage available is crucial for making informed decisions. Car insurance policies can be tailored to fit various needs, and knowing the options can help you select the right coverage.

Liability Coverage Explained

Liability coverage is a fundamental component of car insurance that covers damages to other people or property in the event of an accident. It is typically mandatory in most states and includes bodily injury liability and property damage liability. Bodily injury liability helps pay for medical expenses of others injured in an accident, while property damage liability covers damages to other people’s property.

Comprehensive and Collision Coverage

Comprehensive coverage protects your vehicle against non-accident related damages, such as theft, vandalism, or natural disasters. On the other hand, collision coverage pays for damages to your vehicle in the event of an accident, regardless of who is at fault. Both types of coverage are optional but highly recommended for drivers who want comprehensive protection.

Personal Injury Protection and Medical Payments

Personal Injury Protection (PIP) and Medical Payments coverage help pay for medical expenses for you and your passengers, regardless of fault. PIP coverage is required in some states and can also cover lost wages and other related expenses. Medical Payments coverage, while similar, typically only covers medical expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage protects you if you’re involved in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage can help pay for your medical expenses, lost wages, and other damages.

In conclusion, understanding the different types of car insurance coverage available can help you make informed decisions when selecting a policy. By considering your needs and budget, you can choose the coverage that best protects you and your assets.

- Liability coverage for damages to others

- Comprehensive and collision coverage for vehicle protection

- Personal Injury Protection and Medical Payments for medical expenses

- Uninsured/Underinsured Motorist Coverage for added protection

Factors That Affect Your Car Insurance Rates

Several key factors determine your car insurance rates, and knowing them is crucial. Understanding these elements can help you identify ways to lower your insurance premiums and make informed decisions when choosing a car insurance policy.

Driving Record and History

Your driving record plays a significant role in determining your car insurance rates. A clean driving record with no accidents or tickets can lead to lower premiums, while a history of claims or infractions can increase your rates. Insurance companies view drivers with a good record as less risky.

Vehicle Type, Age, and Safety Features

The type of vehicle you drive, its age, and its safety features are also crucial factors. Newer vehicles with advanced safety features like lane departure warning systems and automatic emergency braking may qualify for lower rates. On the other hand, older vehicles or those with higher theft rates may be more expensive to insure.

Location and Demographic Factors

Where you live and your demographic information can also impact your car insurance rates. Urban areas tend to have higher rates due to increased risk of theft and accidents, while rural areas may have lower rates. Additionally, factors like age, gender, and marital status can influence your premiums.

Credit Score Impact on Insurance Premiums

Your credit score can surprisingly affect your car insurance rates. Insurance companies often use credit-based insurance scores to evaluate the likelihood of a driver filing a claim. Maintaining a good credit score can help you qualify for lower insurance premiums.

By understanding these factors, you can take steps to potentially lower your car insurance rates. For instance, maintaining a clean driving record, choosing a vehicle with good safety features, and improving your credit score can all contribute to more affordable car insurance.

- Maintain a clean driving record to lower premiums.

- Choose vehicles with advanced safety features.

- Improve your credit score.

- Compare insurance quotes from multiple providers.

Finding Affordable Car Insurance: A Step-by-Step Guide

Navigating the complex world of car insurance can be daunting, but with the right approach, you can find affordable coverage that meets your needs. The key is to understand how to compare quotes effectively, utilize online tools, and decide whether to work with insurance agents or direct insurers.

How to Compare Quotes Effectively

Comparing car insurance quotes is more than just looking at the price; it’s about understanding what you’re getting for your money. To compare quotes effectively, you need to ensure you’re comparing similar policies. Look at the coverage limits, deductibles, and any additional features like roadside assistance or rental car coverage. Make sure to check the insurer’s reputation and customer service ratings to ensure you’re getting a good deal from a reliable provider.

Online Tools and Resources for Price Comparison

The internet has made it easier than ever to compare car insurance quotes. Online tools and resources allow you to get quotes from multiple insurers quickly. Websites like Bankrate and NerdWallet offer comparison tools that can help you narrow down your options. Additionally, many insurance companies now offer online quote tools that can give you a quick estimate.

Working with Insurance Agents vs. Direct Insurers

When it comes to purchasing car insurance, you have the option to work with insurance agents or go directly to the insurer. Working with an insurance agent can provide personalized service and guidance, helping you navigate complex insurance products. On the other hand, buying directly from an insurer can sometimes be cheaper and more straightforward. Consider your needs and preferences when deciding which route to take.

Ultimately, finding affordable car insurance requires a combination of research, comparison, and understanding your own needs. By following these steps, you can secure a policy that not only fits your budget but also provides the protection you need on the road.

State-Specific Car Insurance Requirements

Understanding state-specific car insurance requirements is crucial for drivers to comply with the law and avoid penalties. Car insurance regulations vary significantly across the United States, with each state having its own set of rules and minimum coverage requirements.

Minimum Coverage Requirements by Region

Minimum coverage requirements differ by region, and it’s essential for drivers to be aware of the specific requirements in their state. For instance, some states require drivers to carry liability insurance, which covers damages to other parties in the event of an accident. Other states may also require additional coverage, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage.

Drivers can typically find information on their state’s minimum coverage requirements through their state’s Department of Motor Vehicles (DMV) or insurance department website. It’s also a good idea to consult with a licensed insurance agent who can provide guidance on the specific requirements and help drivers choose the right policy.

No-Fault vs. At-Fault Insurance States

The United States has two primary types of car insurance systems: no-fault and at-fault. No-fault insurance states require drivers to carry PIP coverage, which pays for their own medical expenses regardless of who is at fault in an accident. In contrast, at-fault states require drivers to carry liability insurance, which covers damages to other parties if they are found to be at fault in an accident.

Currently, there are 12 no-fault states, including Florida, Michigan, and New Jersey. The remaining states follow the at-fault system. Understanding the type of insurance system in their state is vital for drivers to ensure they have the necessary coverage.

Strategies to Lower Your Car Insurance Premiums

Effective strategies for lowering car insurance premiums involve a mix of comparing quotes, bundling policies, and utilizing usage-based insurance. By adopting these approaches, drivers can significantly reduce their insurance costs without compromising on coverage.

Discounts and Savings Programs

Insurance companies offer various discounts and savings programs that can help lower premiums. These may include discounts for safe driving, student discounts, or discounts for military personnel. It’s essential to inquire about available discounts when comparing insurance quotes.

Bundling Insurance Policies

Bundling insurance policies is another effective way to reduce premiums. By purchasing multiple policies from the same insurer, such as home and auto insurance, drivers can qualify for multi-policy discounts. This not only simplifies insurance management but also leads to cost savings.

“Bundling your home and auto insurance can save you up to 20% on your premiums.” –

Usage-Based Insurance Options

Usage-based insurance options are becoming increasingly popular as they offer premiums based on actual driving habits. These programs use telematics devices or mobile apps to track driving behavior, rewarding safe drivers with lower premiums.

- Monitor your driving habits through a mobile app or telematics device.

- Receive feedback on your driving to improve your habits.

- Enjoy lower premiums for safe driving practices.

Improving Your Credit Score for Better Rates

Many insurers use credit scores to determine premiums, as a good credit score is often associated with lower risk. By improving your credit score, you can qualify for better insurance rates. This involves maintaining a good credit history, paying bills on time, and keeping credit utilization low.

By implementing these strategies, drivers can effectively lower their car insurance premiums while maintaining adequate coverage. Regularly reviewing and adjusting your insurance policies can lead to significant savings over time.

The Car Insurance Claims Process Explained

Navigating the car insurance claims process requires knowledge and preparation. When an accident occurs, understanding the steps to take can significantly impact the outcome of your claim.

Steps to Take After an Accident

After an accident, it’s essential to remain calm and follow a structured approach. First, ensure everyone’s safety and call the authorities if necessary. Documenting the scene with photos and gathering witness statements can be invaluable. Additionally, notify your insurance provider as soon as possible to initiate the claims process.

Key steps include:

- Exchanging information with the other parties involved

- Recording the accident details in your logbook

- Notifying your insurance company promptly

Filing a Claim: What to Expect

Filing a car insurance claim involves several steps, starting with contacting your insurer to report the incident. You’ll need to provide detailed information about the accident, including any supporting documentation like police reports and medical records. The insurance company will then guide you through their specific claims process.

As stated by Consumer Reports, “The key to a successful claim is thorough documentation and prompt communication with your insurer.”

Dealing with Claim Denials and Disputes

If your claim is denied or you’re not satisfied with the settlement, you have the right to dispute the decision. Start by reviewing your policy and understanding the reasons for the denial. You can then contact your insurer to discuss the matter further. If necessary, you may need to escalate the issue to a higher authority or seek external advice.

“It’s crucial to know your rights and the options available when dealing with claim denials,” says a spokesperson for the National Association of Insurance Commissioners.

Understanding the car insurance claims process can help you navigate this complex situation more effectively. By being prepared and knowing what to expect, you can ensure a smoother experience.

Special Considerations for Different Types of Car Insurance Customers

The right car insurance coverage is not one-size-fits-all; it varies based on the driver’s profile. Different demographics and driver characteristics require tailored approaches to car insurance.

Young and First-Time Drivers

Young and first-time drivers often face higher premiums due to their lack of driving experience. Insurance companies view them as higher-risk drivers. To mitigate this, young drivers can consider taking defensive driving courses or maintaining good grades to qualify for discounts.

Senior Drivers

Senior drivers may need to reassess their insurance needs as their driving habits change. Some insurance providers offer mature driver discounts for completing a driving safety course. This can be a beneficial option for seniors looking to lower their premiums.

High-Risk Drivers

High-risk drivers, often due to past accidents or traffic violations, can struggle to find affordable insurance. Specialized insurance policies for high-risk drivers are available, though they may come at a higher cost. Shopping around and comparing quotes can help find the best rates.

Military Personnel and Veterans

Military personnel and veterans may be eligible for exclusive car insurance discounts. Some insurers offer special rates for military members as a token of appreciation for their service. It’s worth inquiring about these discounts when seeking insurance quotes.

Drivers with Unique Vehicles or Situations

Drivers with unique vehicles, such as classic cars or those used for ride-sharing, require specialized insurance coverage. Tailored insurance policies can provide the necessary protection for these unique situations, ensuring that drivers are not over- or under-insured.

Conclusion: Securing the Right Car Insurance for Your Needs

Securing car insurance that meets your needs is crucial for financial protection and peace of mind on the road. By understanding the basics of car insurance, the types of coverage available, and the factors that affect your rates, you can make informed decisions about your car insurance.

Comparing quotes effectively, taking advantage of discounts, and maintaining a good credit score can help lower your premiums. Additionally, being aware of state-specific requirements and the claims process can ensure you’re prepared for any situation.

Whether you’re a young driver, a senior, or a high-risk driver, there’s a car insurance policy tailored to your needs. By applying the knowledge gained from this article, you can secure the right car insurance coverage, protecting yourself and your vehicle from unforeseen circumstances.